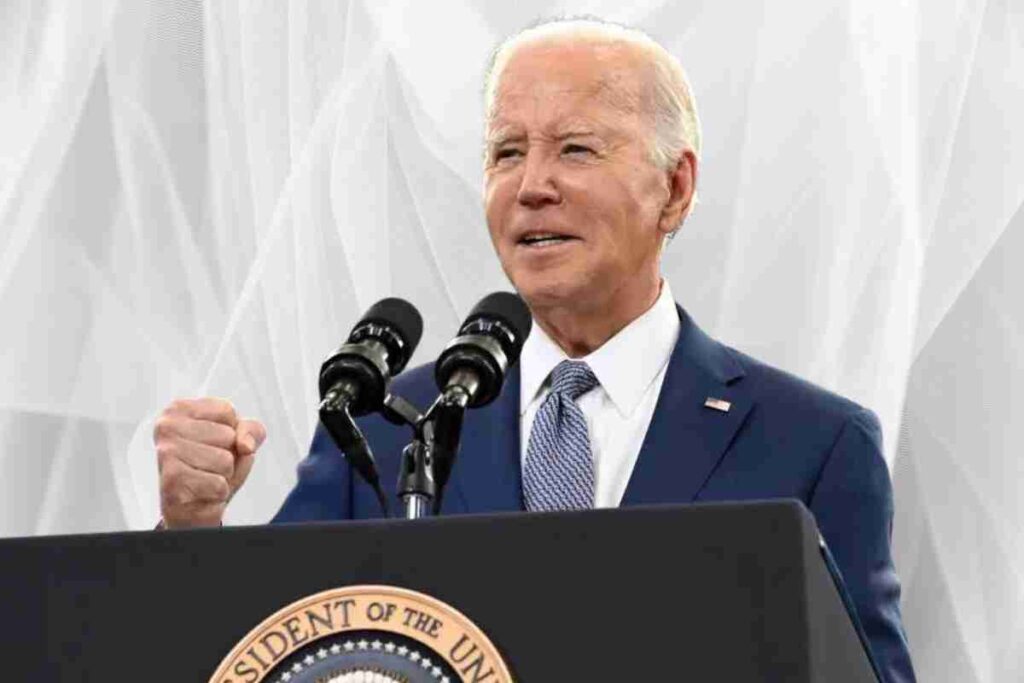

In a significant move to alleviate the financial burden on students, President Biden has recently announced a groundbreaking initiative. Under this program, a staggering $4.9 billion in new student loan forgiveness has been approved. This bold step aims to reshape the higher education landscape and provide much-needed relief to countless graduates. Let’s delve into the key details of this transformative policy.

Understanding the Initiative

What Is the New Student Loan Forgiveness Initiative?

The new student loan forgiveness initiative, spearheaded by President Biden, seeks to address the mounting student loan debt crisis. It’s a comprehensive program aimed at relieving the financial strain on borrowers.

Why Is This Initiative Necessary?

The initiative recognizes the dire need to alleviate the financial burden on students and recent graduates. Mounting student loan debt has become a significant obstacle to economic prosperity for many young Americans.

How Will It Impact Borrowers?

This initiative will provide substantial relief to borrowers, reducing or eliminating their student loan debt burdens. It’s expected to improve financial stability and offer greater economic opportunities to those affected.

Key Provisions

Eligibility Criteria

To benefit from this program, borrowers must meet specific eligibility criteria, including income thresholds and other requirements. It’s essential to understand who qualifies for this loan forgiveness.

Loan Forgiveness Amounts

Under this initiative, borrowers can expect varying degrees of loan forgiveness based on their financial circumstances. Some may qualify for complete loan forgiveness, while others will receive partial relief.

Federal vs. Private Loans

This program primarily addresses federal student loans. Understanding the distinction between federal and private loans is crucial for borrowers to assess their eligibility.

Tax Implications

While loan forgiveness is a significant relief, it’s essential to be aware of any potential tax implications that may arise as a result.

Application Process

Navigating the application process is a critical step for borrowers seeking loan forgiveness. Understanding the steps involved will help applicants successfully avail themselves of this opportunity.

Also, Read The Ultimate Guide to the Best Winter 2024 Anime on Crunchyroll

FAQs

1. Who is eligible for the new student loan forgiveness initiative?

- Borrowers who meet specific income thresholds and other criteria are eligible.

2. How much loan forgiveness can I expect?

- The amount of forgiveness varies based on individual circumstances, but it can be substantial.

3. Will private loans be forgiven under this initiative?

- No, this program primarily addresses federal student loans.

4. What are the tax implications of loan forgiveness?

- Borrowers should be aware of potential tax consequences when their loans are forgiven.

5. How can I apply for loan forgiveness?

- Applicants must follow a specific application process outlined by the government.

6. Is there a deadline for applying for loan forgiveness?

- While there may not be a strict deadline, it’s advisable to apply as soon as possible to benefit from the program.

Conclusion

President Biden’s approval of $4.9 billion in new student loan forgiveness marks a significant step toward addressing the student debt crisis. This initiative aims to provide relief to those burdened by student loans and create a path to financial stability. As borrowers navigate the complex terrain of loan forgiveness, understanding the key details and eligibility criteria is essential. With this transformative policy, a brighter financial future may be on the horizon for countless Americans. Stay informed and explore the opportunities this initiative presents.

Follow us on Facebook